Automatizar las reglas de impuestos por código postal

Los cambios impositivos ocurren con regularidad, por lo que puede ser difícil realizar un seguimiento y actualizar los tipos impositivos manualmente cuando ocurren cambios. Con el cálculo de impuestos automatizado, las tasas de impuestos se actualizan automáticamente según el código postal del comprador. Solo agrega los estados en los que debes recaudar impuestos y nosotros nos ocuparemos del resto.

Configura cómo recaudar los pagos de impuestos en los estados donde tienes un nexo económico. Aquí es donde tu negocio ha obtenido suficientes ingresos dentro de un estado dado para comenzar a cobrar el impuesto sobre las ventas.

- Ve a la página de tu producto GoDaddy.

- Desplázate hacia abajo, expande Websites + Marketing y selecciona Administrar al lado de tu sitio.

- En tu panel de control, expande Comercio y luego selecciona Configuración .

- Selecciona Impuesto sobre las ventas .

- Junto a Cálculo de impuestos a nivel de código postal , selecciona Activar .

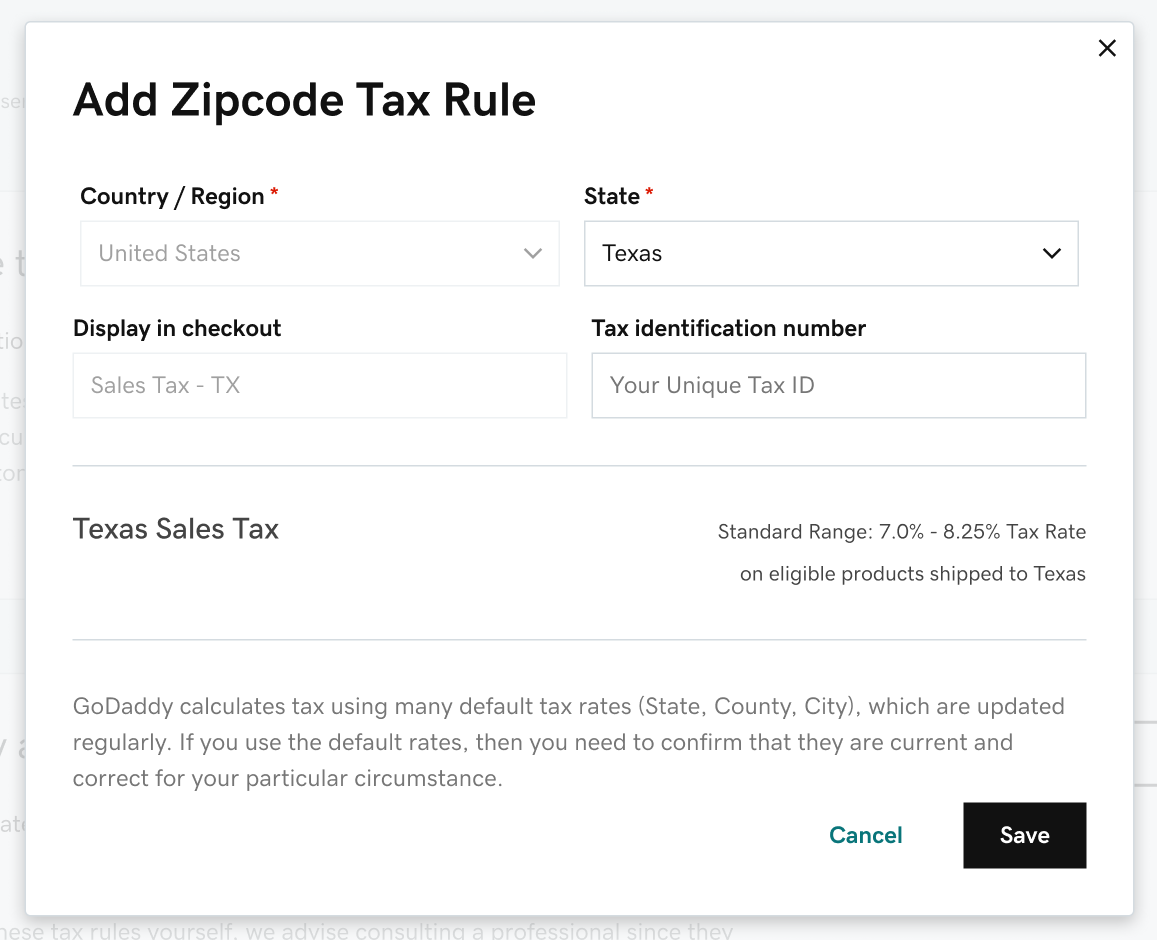

- Selecciona Agregar estado y selecciona un estado de la lista desplegable.

- Si tienes un número de identificación fiscal, introdúcelo. Te mostraremos el rango de impuestos en varios códigos postales para el estado seleccionado.

- Selecciona Guardar para aplicar la configuración de la ubicación y volver a la página de Impuestos .

- Para agregar más estados, selecciona Agregar estado y repite los pasos según sea necesario.

Nota: Una vez que hayas habilitado las tasas de impuestos del código postal automático, todos los productos en tu tienda serán gravados por defecto. Si no deseas cobrar impuestos sobre un producto específico, ve a la página de detalles de ese producto y desactiva la opción Impuesto sobre las ventas .