Run a taxes report

A taxes report shows you the amount of taxes paid on transactions through GoDaddy Payments during the reporting period. You can generate a taxes report through the Dashboard in your web browser or on your GoDaddy Smart Terminal.

Taxes reports include a summary of each type of tax, a daily total for all taxes, and a breakdown of each order or transaction in which a tax was applied, including the transaction ID, tax type and order status.

- Sign in to the Dashboard where you manage your GoDaddy Payments account (use your GoDaddy username and password).

- Select Reports.

- Select Taxes Report.

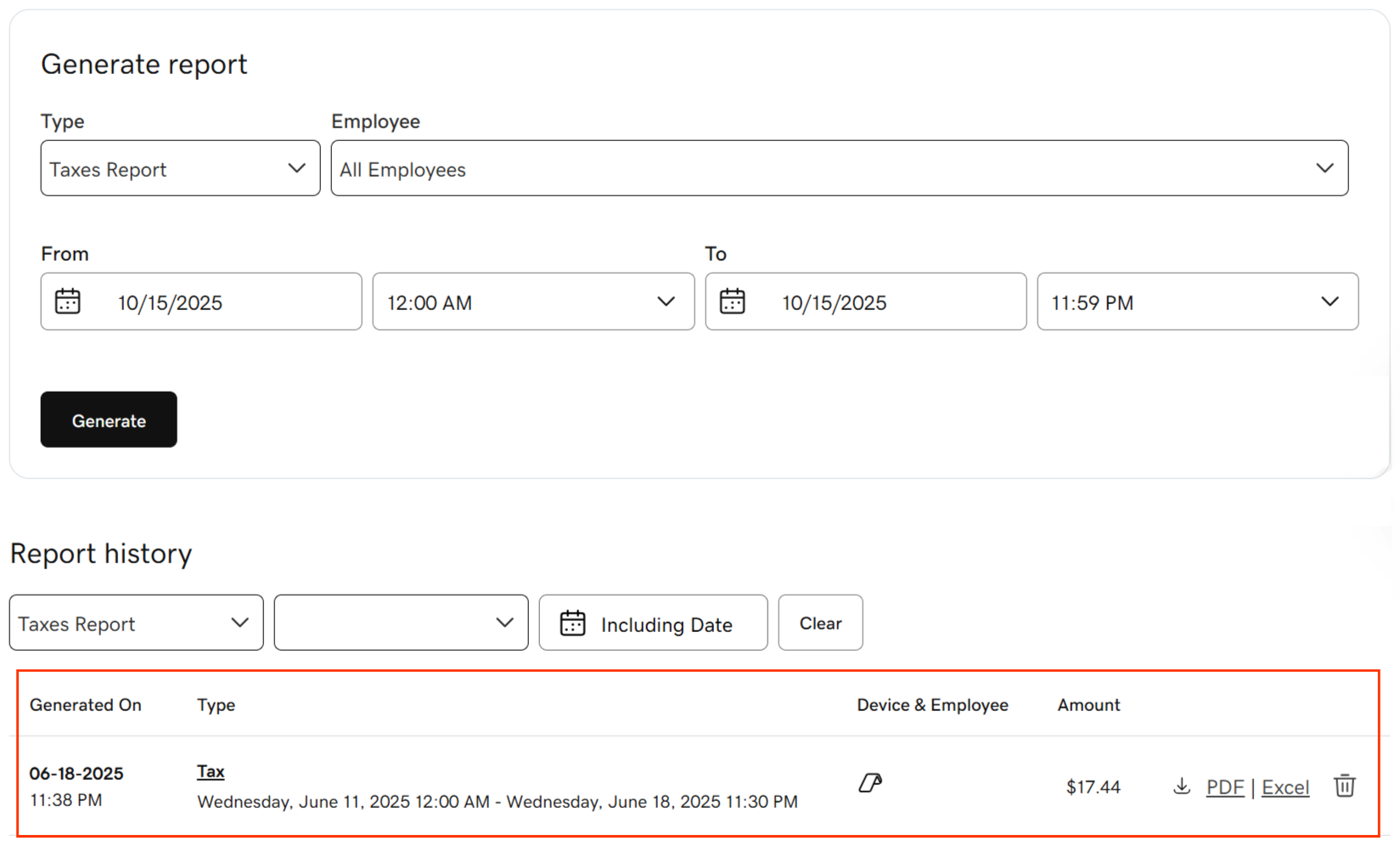

- In the Type dropdown menu, ensure that Taxes Report is selected.

- In the To and From fields, specify the date range for the report.

- Select Generate to pull your report. (This can take a few minutes.)

- You'll receive an email notification when the report is ready. Select the link in the email to return to Reports. The report will appear below your filter selections.

- Select the report to review a summary and breakdown of transactions during the selected time period. You can also adjust the report format depending on how you want to use the data:

- To download the report in Excel, select Excel. You can filter the report data in Excel by different variables (for example, transactions processed by a specific employee).

- To download the report in PDF format, select PDF (if available).

- Use the filters above the report list (under Report History) to locate a previously generated report based on the report type and/or the date the report was generated.

- From your Smart Terminal home screen, tap Settlements or Deposit.

- Tap Reports in the lower-right corner.

- Tap Generate Report.

- In the Type dropdown menu, tap Taxes.

- In the Start date and End date fields, specify the date range for the report.

- In the Employee field, tap a specific employee. Or – leave the field as All employees to run a complete report of every transaction in that date range.

- Tap Generate to pull your report.

- When the report is ready, it will appear on your Smart Terminal screen. Tap View to open and review it.

Note: Reports created on the Smart Terminal will also display in your web browser Dashboard under Reports. Access them in your web browser to download a PDF or Excel version of the report.

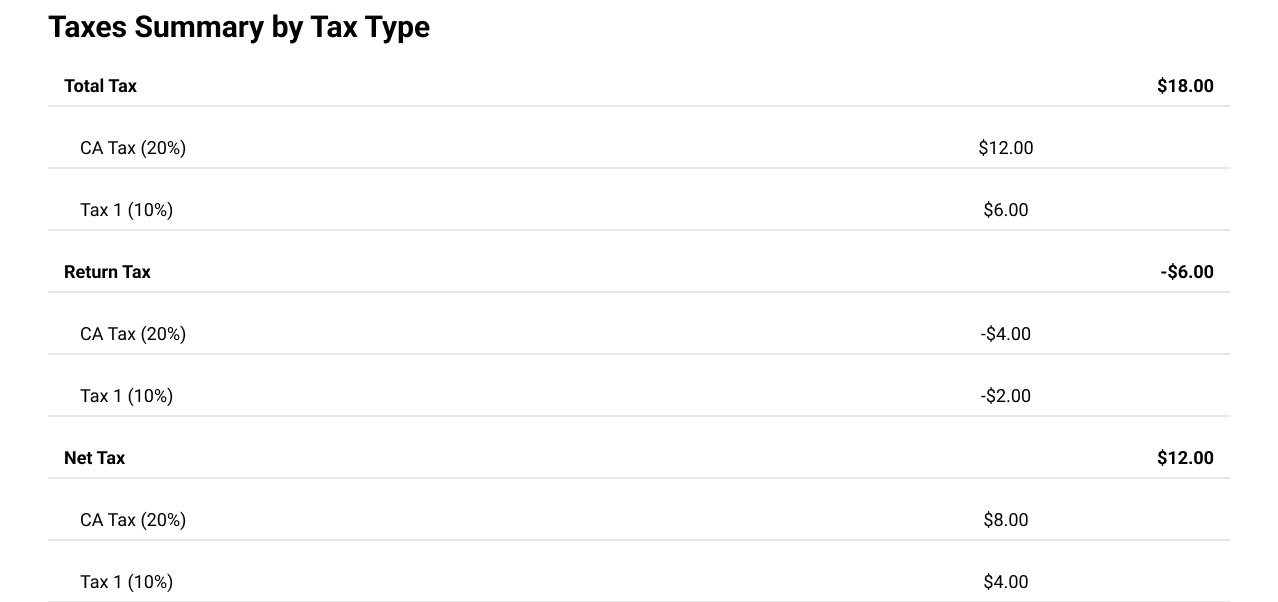

The taxes report includes several sections. At the top, there's a Taxes Summary by Tax Type section that displays

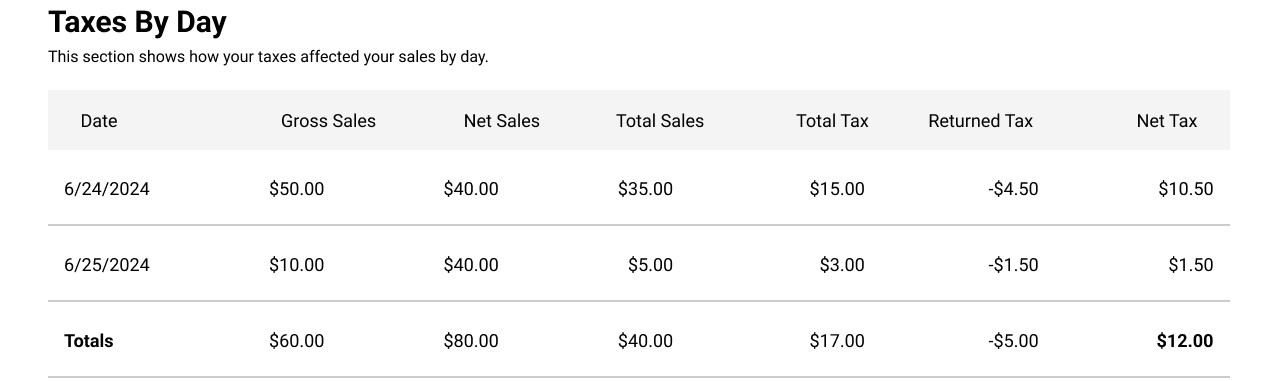

Below, there's a Taxes by Day section that displays the dollar amount of Gross Sales, Net Sales, Total Sales, Total Tax, Returned Tax and Net Tax for each day with their totals added below.

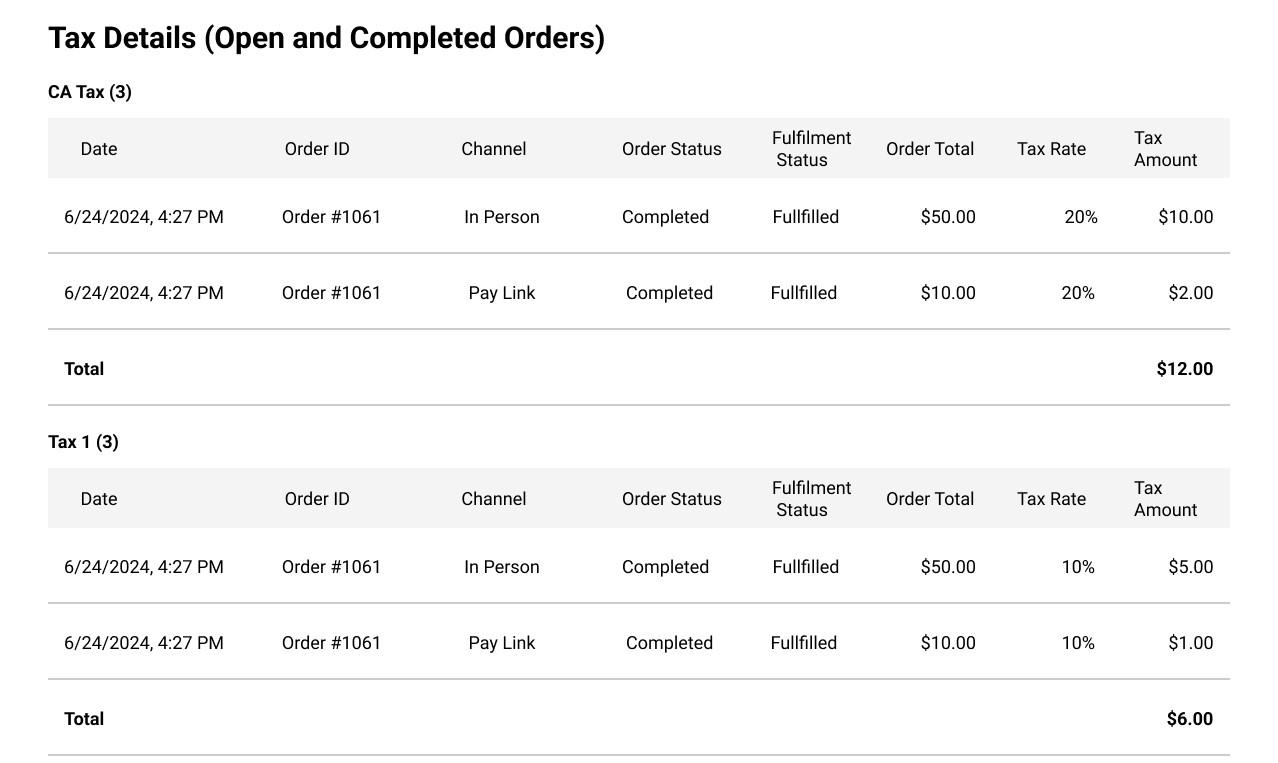

In the last three sections you can find tax details for Open and Completed Orders, Open and Completed Returns, and Cancelled Orders. Each of these sections contains detailed breakdown for each tax type and there you can find information like date, order ID, channel, order status, fulfillment status, order total (in dollar amount), tax rate (in percentage) and tax amount.

When the report is exported to Excel, each section is displayed as a tab in the Excel sheet.

More info

- What are the metrics in my GoDaddy Payments reports?

- What reports do I have access to?

- Find out how to create and apply taxes to an order.

- Want more details about a specific transaction? Review your individual transactions.